February 2024 New Residential Construction

What happened

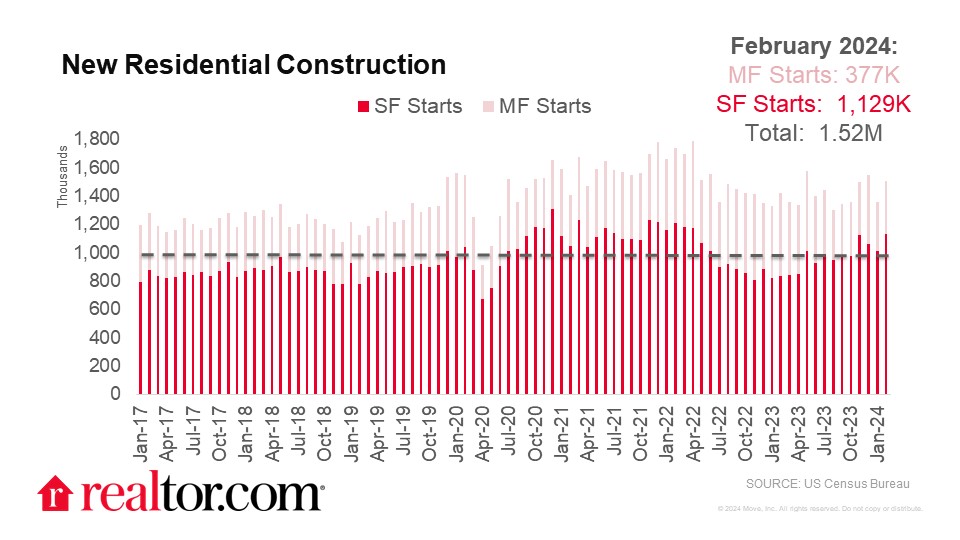

New residential construction activity surged 10.7% month over month in February, reaching a rate of 1,518,000 annual housing starts (+5.9% year over year). Builder sentiment picked up for the fourth month in a row in March, rising to an index of 51, the highest level since July 2023 and 7 points higher than one year ago, signaling a shift in builder optimism.

The monthly uptick in housing starts was driven by a respective 11.6% and 8.6% pickup in single- and multi-family starts. Single-family housing starts reached 1,129,000 in February, the highest level since April 2022 and 35.2% higher than one year ago. Multi-family starts picked up month over month but remained 35.9% lower annually as construction activity shifted toward single-family.

Though mortgage rates crept back toward 7% in February, buyers expect mortgage rates to fall this year, and builders are ramping up production in response. It remains unclear when mortgage rates may fall as the potential decline remains dependent on easing inflation, which has not happened quite yet. After fairly strong employment and inflation readings, the market expects the FOMC to hold interest rates steady at Wednesday’s meeting, pushing rate cuts out until the latter half of the year.

What do housing permit trends tell us

Housing permit activity picked up in February as well. Overall permits increased 1.9% month over month (+2.4% year over year) as both single- and multi-family permits increased. Single-family permits rose 1.0% month over month, to reach a level 29.5% higher than in February 2023. Multi-family permits picked up 2.4% monthly but remained 32.8% lower than one year prior.

The Northeast (+36.2% mm, +79.6% yy) and Midwest (+3.8% mm, +14.9% yy) saw both monthly and annual pickup in permits while the South (-1.3% mm, -5.1% yy) and West (-6.8% mm, -11.2% yy) saw declines. All four regions saw annual pickups in single-family permits, however.

What do completions mean for housing supply

Home completions reached an annual rate of 1,729,000 homes in February, 19.7% higher than January, 9.6% higher than one year prior, and the highest level since January 2007. Single- and multi-family home completions picked up by 20.2% and 20.8%, respectively, making for annual gains of 4.2% and 18.8%. Single-family completions reached an annual rate of 1,072,000, the highest rate since November 2022, which was the highest level since 2007.

More single-family home construction is great news for the housing market, which has remained largely undersupplied over the past decade. Home completions picked up in all regions except the West, both month over month and year over year.

What does this mean for homebuyers, sellers, homeowners, and the housing market

New listing activity picked up 11.3% in January, bringing active inventory 14.8% higher. Though buyers are seeing more for-sale inventory, sustained demand means prices are holding relatively steady on an annual basis.

An uptick in new-construction supply may help relieve some upward pressure on prices as we head into the spring, a season when buyer activity ramps up. Based on the latest Fannie Mae Housing Survey, buyers are feeling optimistic about mortgage rates falling this year. An all-time survey high 36% of respondents expect mortgage rates to fall over the next 12 months.

Based on new-construction data, builders are also looking toward the future of the housing market with some optimism, preparing to bring supply to a still-undersupplied market as pent-up buyer demand awaits more affordable housing.