Industry News

Foreclosures Tick Up, Especially in These Cities

More homes are in danger of going into foreclosure—especially in certain cities that have had challenges ever since the last housing crisis in the late 2000s. There were nearly 34,000 properties with foreclosure filings in August, according to a recent report from...

There Haven’t Been This Few Homebuyers in the Market Since 1996

The onerous combination of high mortgage rates and few homes for sale is keeping homebuyers out of the market. As the fall housing market kicks off, the number of mortgage applications dropped to their lowest level since 1996 in the week ending Sept. 8, according to...

Smart Home Technology: Enhancing Convenience and Efficiency in Modern Living

In the fast-paced digital age, the concept of a "smart home" has rapidly gained popularity, revolutionizing the way we interact with and manage our living spaces. Smart home technology offers a seamless integration of devices and systems that enhance convenience,...

Mastering Mortgage Management: Tips for Paying Off Your Mortgage Early and Saving Thousands

For many homeowners, a mortgage is the largest financial commitment they will ever make. While owning a home is a significant achievement, the prospect of paying off a mortgage over several decades can feel daunting. However, with careful planning and strategic...

Amazingly, 2023 Is Not the Most Unaffordable It’s Ever Been To Buy a Home—Not Even Close

Yes, we’ve all heard it. Buying a home today might seem like the most unaffordable, and therefore impossible, it’s ever been. Home prices are near record levels, pushed up by bidding wars erupting on anything well-situated and move-in ready. Plus, mortgage rates are...

Mortgage Rates Are About 7%. Are They Coming Down Anytime Soon?

Homebuyers watching mortgage rates should buckle up—but they probably won’t enjoy this ride. Mortgage interest rates were above 7% for the past two weeks—much to the dismay of many cash-strapped buyers. They averaged 7.09% on Tuesday before falling to 6.96% on...

14 Sneaky Staging Tips for Selling a Small Home

These days it seems like everybody wants a tiny house. But what if your home isn’t adorably tiny? What if it’s just sadly small? Don’t worry—it’s not your square footage that matters most; it’s how you present it. Even if you’re tight on space, you can fool buyers...

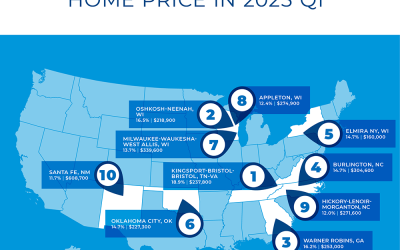

Almost Seven in 10 Metro Areas Posted Home Prices Gains in the First Quarter of 2023

WASHINGTON (May 9, 2023) – Nearly seven out of 10 metro markets registered home price gains in the first quarter as 30-year fixed mortgage rates fluctuated between 6.1% and 6.7%, according to the National Association of REALTORS®' latest quarterly report. Seven...

Fed’s Recent Rate Hike was Unnecessary says NAR Chief Economist Lawrence Yun

WASHINGTON (May 10, 2023) – National Association of Realtors® Chief Economist Lawrence Yun said the Federal Reserve's most recent rate hike was unnecessary, and he expects the Fed will stop raising interest rates further, during the "Residential Economic Issues &...

Real Estate Photographers Reveal the One Listing Photo That Can Make—or Break—a Sale

Where do all eyes go first when perusing a real estate listing? The photos, of course. Home sellers should never underestimate the importance of investing in a professional real estate photographer to get the very best pictures possible of their place. Because no...