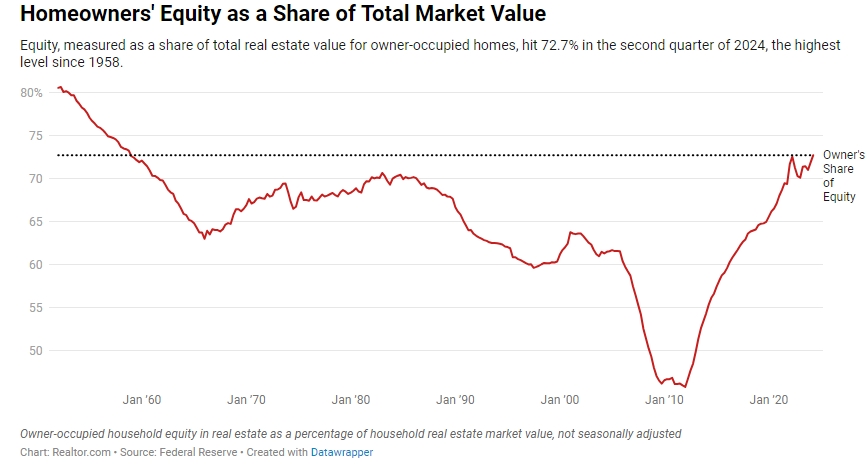

Homeowners in the U.S. are sitting on their highest share of home equity since the 1950s, following a period of rapid price increases.

Equity, measured as a share of total real estate value for owner-occupied homes, hit 72.7% in the second quarter of 2024, the highest level since 1958, according to the Federal Reserve’s latest report on financial accounts. Although mortgage debt continued to climb, home values increased at a faster pace, expanding homeowner share of equity, explains Realtor.com® economist Jiayi Xu.

“This trend reflects a housing market where increased demand and limited inventory have propelled property values, significantly enhancing homeowner equity and its share,” says Xu. The total value of owner-occupied real estate, or the market value of all homes owned by those living in them, reached a new record high of $48.2 trillion for the quarter, up 8% from a year ago and double the aggregate value of all owner-occupied homes in the country 10 years ago.

Total mortgage debt in the U.S. also hit a new record of $13.1 trillion, but it grew more slowly as home sales remained sluggish in the quarter. Mortgage debt was up just 3% from a year ago and 40% from a decade earlier. Meanwhile, aggregate homeowner equity reached a new high of $35.1 trillion for the quarter, up 10% from a year ago and triple what it was 10 years ago.

The growth in total equity reflects a combination of rising home values, the expansion of owner-occupied housing stock with new construction, and the growing share of homes that are owned outright as aging baby boomers fully pay off their mortgages. According to U.S. Census Bureau data, nearly 40% of owner-occupied homes in the country are mortgage-free, the highest share since 2005.

Together it means that homeowners have the highest share of equity since the 1950s, when the homeownership rate was significantly lower and VA and FHA loans were relatively new creations. Last quarter, the average equity for existing homeowners was roughly around $267,000, giving homeowners a significant cushion even if home values decline.

Even if home values dropped 10% overnight, the total homeowner share of equity would still be 69.7%, roughly where it stood in late 2021. A 20% drop in home values would take equity share to 2019 levels. Neither of those scenarios is likely, but they illustrate the relatively robust position of the typical homeowner in today’s market. Home values would have to drop severely to send most homes underwater, although the most recently purchased homes would be at the greatest risk.