Signs of rising inflation around the world are keeping investors on edge. But in some corners of markets, pressure is easing, raising hopes that Peak Fear may have passed and central banks will be confident enough to sit tight.

What’s happening: The price of lumber, fed by a construction boom, has dropped 40% from the all-time high it reached in early May, while copper prices have fallen back 11%. Corn prices are 14% lower.

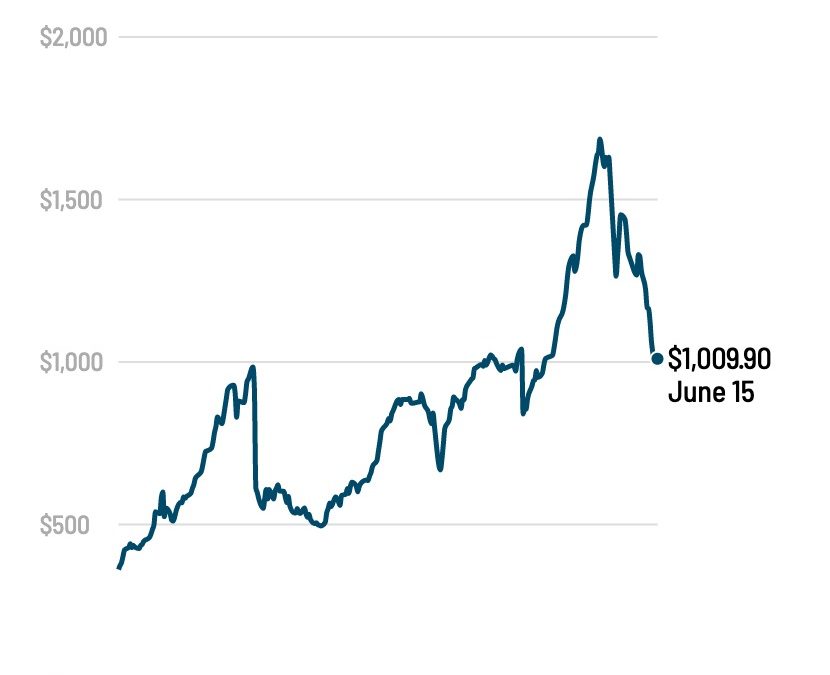

Long-term bets on commodities just overtook bullish bets on bitcoin as the most crowded trade in markets, according to Bank of America’s latest survey of global fund managers. That could be a sign that the commodities surge, which is causing prices to rise, may have run its course.

Broader economic data closely monitored by policymakers is telling a different story, however. US producer prices jumped a record amount last month, increasing 6.6% between May 2020 and May 2021, according to figures released Tuesday. In the United Kingdom, consumer prices leaped 2.1% in the year to May, the Office for National Statistics said Wednesday, with clothing, dining out and fuel getting more expensive. This jump above the Bank of England’s 2% inflation target wasn’t expected until later this year, according to its May monetary policy report.

“While [consumer price] inflation remains well below the 5% rate recorded in the US, there has so far been more ‘reopening inflation’ in the UK than we had expected,” Paul Dales, chief UK economist at Capital Economics, said in a research note. This puts central banks in a difficult spot. Price pressures could be transitory, but there are still worries that inflation could be making a more permanent comeback after staying muted for decades. The Bloomberg Commodity Index remains just 1.9% below its recent peak.

In that context, the Federal Reserve — which makes its latest policy announcement on Wednesday — is expected to indicate that it’s at least thinking about how to move away from the super-supportive policies it put in place during the pandemic, which have flooded the US economy with cash. “Partly because of the recent surprisingly strong inflation, the Fed is likely to begin discussing an exit from its ultra-expansive monetary policy,” Commerzbank’s chief economist Jörg Krämer recently told clients.

On the radar: Investors want to know when the Fed will ease up on its massive asset buying program, which is expected to be the first major step it takes toward policy normalization. The Fed is still purchasing $120 billion in securities per month. “A change of course by the Fed, which is thus probably approaching, is always a critical matter for the markets,” Krämer said. Krämer thinks it’s too soon for Fed Chair Jerome Powell to officially signal a new course, though he’ll likely have to field difficult questions at his press conference. Instead, a real shift could come next quarter — well in advance of any actual moves, so markets have time to stomach them.